In 1720, during the height of the "South-Sea Bubble" in the London stock market, one entrepreneur founded

A company for carrying on an undertaking of great advantage, but nobody to know what it is. In six hours he sold £2,000 of stock (equivalent to millions of dollars in today's money), then disappeared to the continent and was never heard from again. It was indeed an undertaking of great advantage, but only for one person. We might hope that today's investors are more sophisticated, but the continuing success of pump and dump stock scams suggests otherwise.

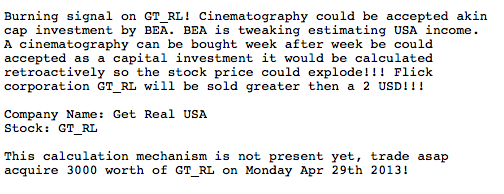

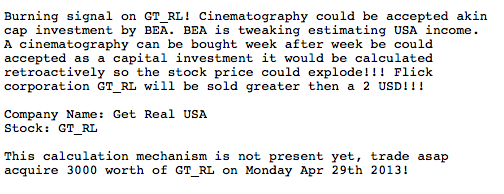

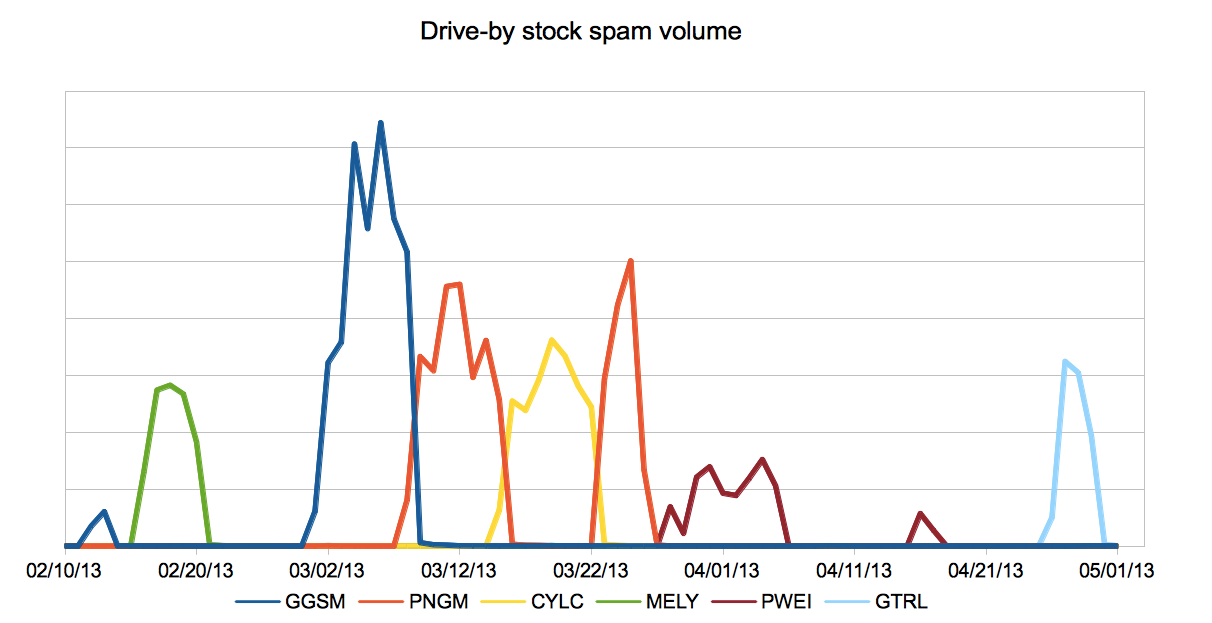

Cloudmark sees two main types of pump and dump spam, that I call the drive-by and the targeted. The drive-by stuff is traditional spam: many millions of emails sent from a botnet to a random list of addresses, with no indication who is promoting the stock. There are usually mistakes in grammar or even complete nonsense in the text. Here's an example:

This stuff is easy for us to filter, and the tiny fraction of that is read by humans is unlikely to be persuasive. These attacks tend to feature one stock at a time, so it seems like there is a single operator responsible for them.

Much more pernicious are the targeted emails. These go out to mailing lists for "hot stock tips" that people have actually signed up for, and are often backed by paid blog posts and comments on stock discussion forums promoting the stock. The Motley Fool web site had a great recent

blog post on how this process works.

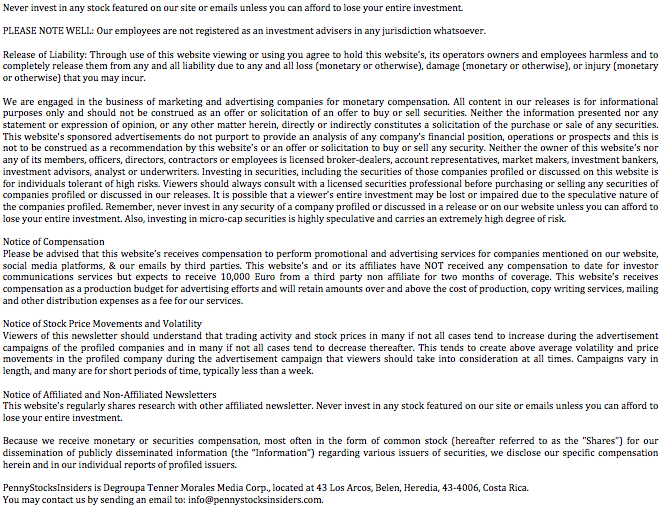

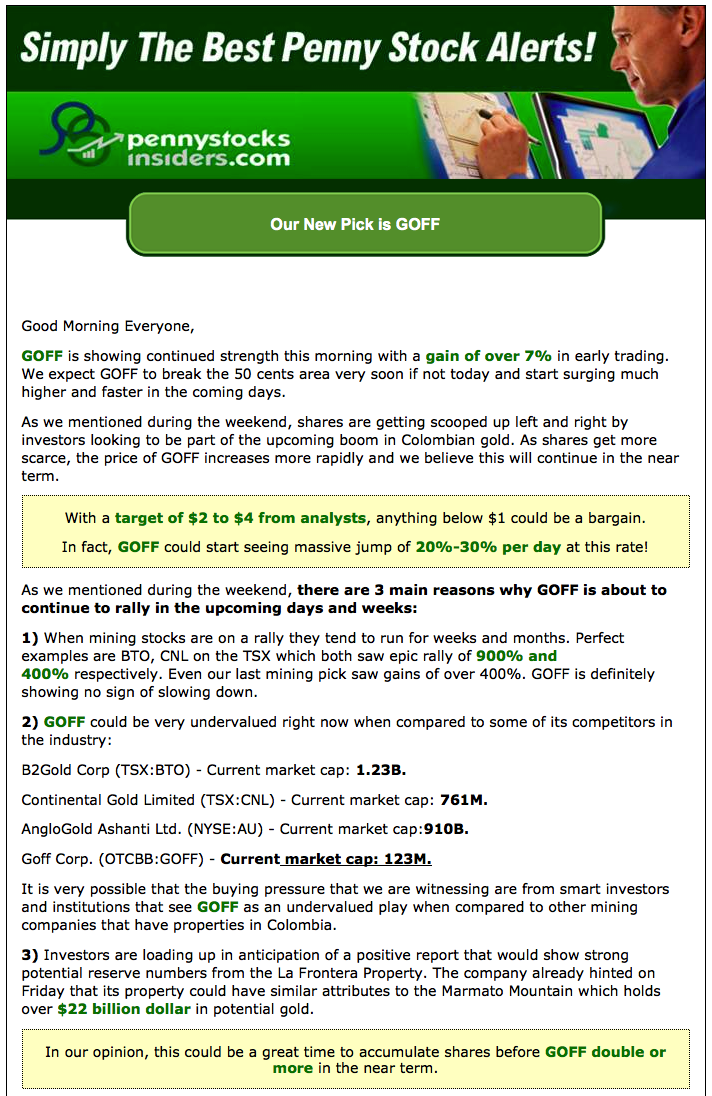

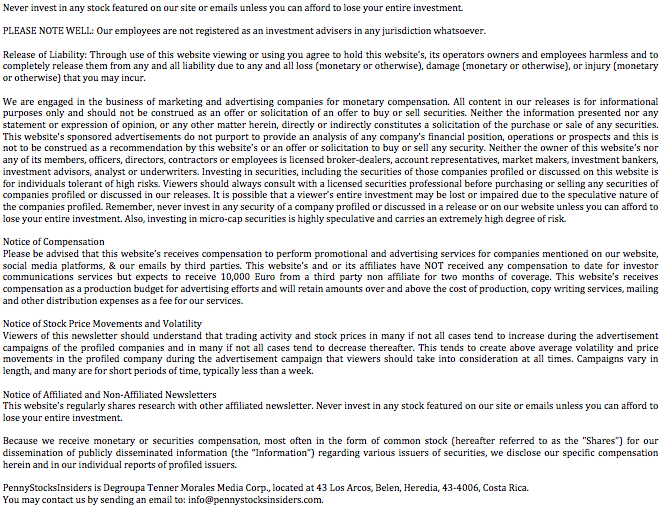

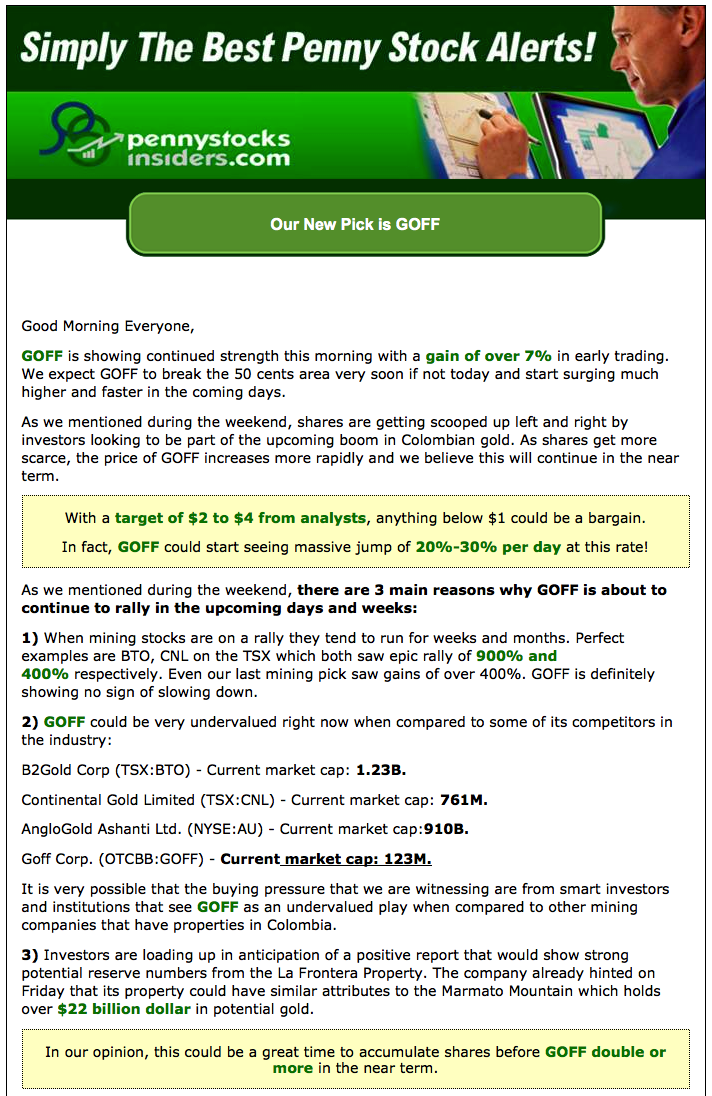

On the right is one of the emails promoting the stock that Motley Fool discussed. It looks really exciting and it's full of numbers about other companies, but the company it is promoting has no revenue, less than $10,000 cash in hand and a negative book value. Also, I'm not showing you the whole email. Down at the bottom there is a disclaimer in fine print, in an attempt to stay legal. It's actually included in the email as an image, so even if you increase the font size it's still hard to read, and if you have external images turned off in you email you won't see it at all. Here it is

Notice that when the print is the same size the disclaimer is much longer than the ad copy. To reduce it to one sentence, what it says is, "We are being paid to say this and don't really mean it."

Generally, the people paying for the stock promotions are insiders who control the company and own most or all of the stock - they can create more if they want to. The point of the promotion is not to increase the price, but to increase the volume of stock traded, so they have a market for their worthless paper. In some cases following a pump and dump promotion the stock value goes straight down as insiders compete with one another to dump their stock fastest. In others it may go up for a while but it will always go down in the long run. Note that insiders can manipulate the listed price with

wash trades, that is selling stock to themselves at artificially inflated prices. In the long term the prices of stocks that are promoted like this almost always end up going down.

You might think that you could make money by shorting these stocks (that is, betting they will go down) but in practice it is hard to short in any volume in such illiquid markets. There are some experts who claim that you can make money by second guessing stock manipulators, and it may be possible for some. You can also make a living playing poker; that too takes study, dedication, nerves of steel and the willingness to lose a large sum of money and go on playing.

So who is sending out these stock promotion newsletters? The

PumpsAndDumps.com web site, which monitors stock promotions, has a handy

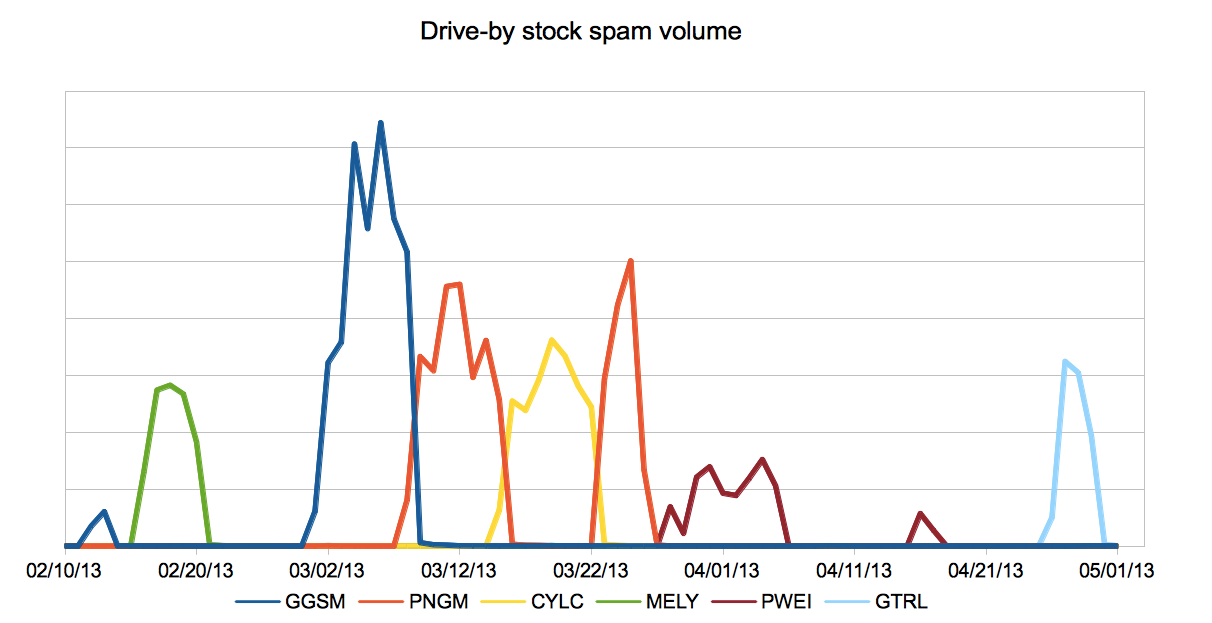

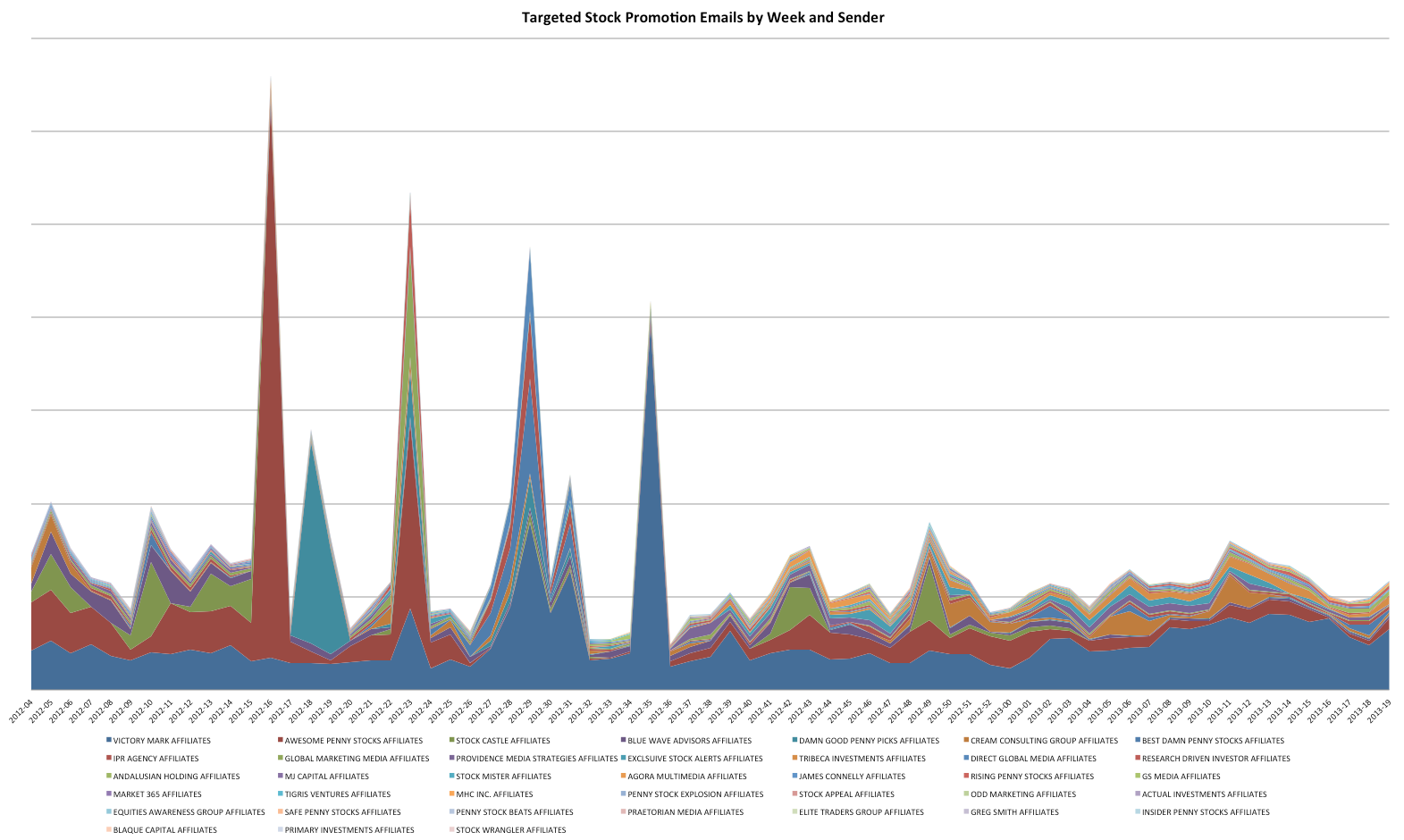

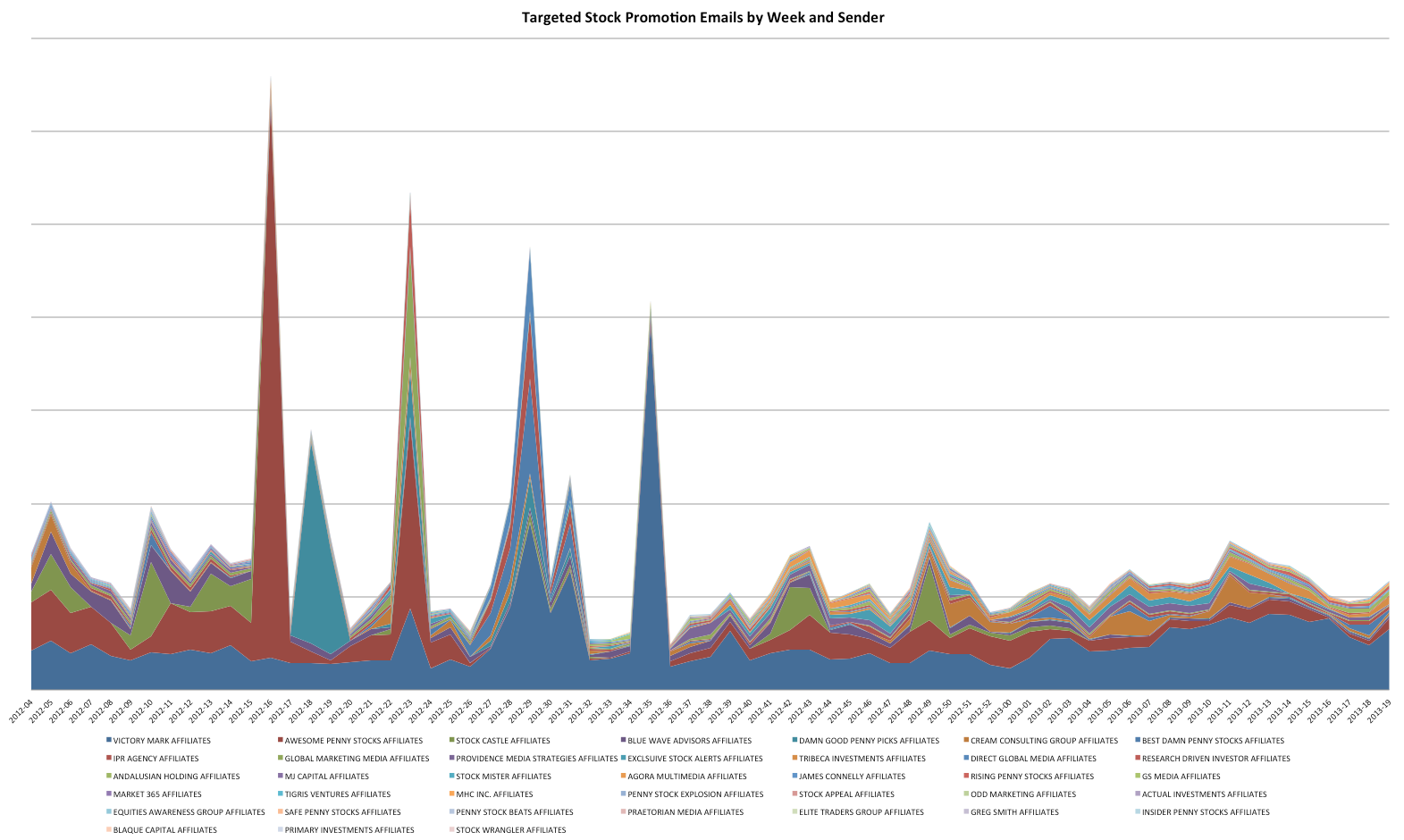

list of stock touts. Though all of the operators have multiple web sites, Pumps & Dumps had them neatly listed by owner. I took the volumes of email we have seen referencing each web site and grouped in this way. Here's the result.

[caption id="attachment_2965" align="aligncenter" width="566"]

Click for high resolution image[/caption]

It looks as if last year the promoters experimented with occasionally sending to a much larger mailing list, but for the most part this year have been restricting their mailings to people who have signed up on one of their web sites. This is a smart move on their part as it means that spam filtering services such as Cloudmark's are much less likely to blacklist their mailings.

Almost sixty percent of the stock promotion emails over the period I listed come from just two corporations, Awesome Penny Stocks and Victory Mark. Not so coincidentally, these two were recently

sued for spamming by anti-pump and dump campaigner

George Sharp. While I can't comment on lawsuits in progress, you rock George.

Finally, let's return to 1720 and the South-Sea company. Robert Walpole, speaking in parliament, warned against stock speculation. It would, he said, "divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth. The great principle of the project was an evil of first-rate magnitude; it was to raise artificially the value of the stock, by exciting and keeping up a general infatuation, and by promising dividends out of funds which could never be adequate to the purpose." Nobody listened to him back then, either.

More resources

On the right is one of the emails promoting the stock that Motley Fool discussed. It looks really exciting and it's full of numbers about other companies, but the company it is promoting has no revenue, less than $10,000 cash in hand and a negative book value. Also, I'm not showing you the whole email. Down at the bottom there is a disclaimer in fine print, in an attempt to stay legal. It's actually included in the email as an image, so even if you increase the font size it's still hard to read, and if you have external images turned off in you email you won't see it at all. Here it is

Notice that when the print is the same size the disclaimer is much longer than the ad copy. To reduce it to one sentence, what it says is, "We are being paid to say this and don't really mean it."

Generally, the people paying for the stock promotions are insiders who control the company and own most or all of the stock - they can create more if they want to. The point of the promotion is not to increase the price, but to increase the volume of stock traded, so they have a market for their worthless paper. In some cases following a pump and dump promotion the stock value goes straight down as insiders compete with one another to dump their stock fastest. In others it may go up for a while but it will always go down in the long run. Note that insiders can manipulate the listed price with wash trades, that is selling stock to themselves at artificially inflated prices. In the long term the prices of stocks that are promoted like this almost always end up going down.

You might think that you could make money by shorting these stocks (that is, betting they will go down) but in practice it is hard to short in any volume in such illiquid markets. There are some experts who claim that you can make money by second guessing stock manipulators, and it may be possible for some. You can also make a living playing poker; that too takes study, dedication, nerves of steel and the willingness to lose a large sum of money and go on playing.

So who is sending out these stock promotion newsletters? The PumpsAndDumps.com web site, which monitors stock promotions, has a handy list of stock touts. Though all of the operators have multiple web sites, Pumps & Dumps had them neatly listed by owner. I took the volumes of email we have seen referencing each web site and grouped in this way. Here's the result.

[caption id="attachment_2965" align="aligncenter" width="566"]

On the right is one of the emails promoting the stock that Motley Fool discussed. It looks really exciting and it's full of numbers about other companies, but the company it is promoting has no revenue, less than $10,000 cash in hand and a negative book value. Also, I'm not showing you the whole email. Down at the bottom there is a disclaimer in fine print, in an attempt to stay legal. It's actually included in the email as an image, so even if you increase the font size it's still hard to read, and if you have external images turned off in you email you won't see it at all. Here it is

Notice that when the print is the same size the disclaimer is much longer than the ad copy. To reduce it to one sentence, what it says is, "We are being paid to say this and don't really mean it."

Generally, the people paying for the stock promotions are insiders who control the company and own most or all of the stock - they can create more if they want to. The point of the promotion is not to increase the price, but to increase the volume of stock traded, so they have a market for their worthless paper. In some cases following a pump and dump promotion the stock value goes straight down as insiders compete with one another to dump their stock fastest. In others it may go up for a while but it will always go down in the long run. Note that insiders can manipulate the listed price with wash trades, that is selling stock to themselves at artificially inflated prices. In the long term the prices of stocks that are promoted like this almost always end up going down.

You might think that you could make money by shorting these stocks (that is, betting they will go down) but in practice it is hard to short in any volume in such illiquid markets. There are some experts who claim that you can make money by second guessing stock manipulators, and it may be possible for some. You can also make a living playing poker; that too takes study, dedication, nerves of steel and the willingness to lose a large sum of money and go on playing.

So who is sending out these stock promotion newsletters? The PumpsAndDumps.com web site, which monitors stock promotions, has a handy list of stock touts. Though all of the operators have multiple web sites, Pumps & Dumps had them neatly listed by owner. I took the volumes of email we have seen referencing each web site and grouped in this way. Here's the result.

[caption id="attachment_2965" align="aligncenter" width="566"] Click for high resolution image[/caption]

It looks as if last year the promoters experimented with occasionally sending to a much larger mailing list, but for the most part this year have been restricting their mailings to people who have signed up on one of their web sites. This is a smart move on their part as it means that spam filtering services such as Cloudmark's are much less likely to blacklist their mailings.

Almost sixty percent of the stock promotion emails over the period I listed come from just two corporations, Awesome Penny Stocks and Victory Mark. Not so coincidentally, these two were recently sued for spamming by anti-pump and dump campaigner George Sharp. While I can't comment on lawsuits in progress, you rock George.

Finally, let's return to 1720 and the South-Sea company. Robert Walpole, speaking in parliament, warned against stock speculation. It would, he said, "divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth. The great principle of the project was an evil of first-rate magnitude; it was to raise artificially the value of the stock, by exciting and keeping up a general infatuation, and by promising dividends out of funds which could never be adequate to the purpose." Nobody listened to him back then, either.

More resources

Click for high resolution image[/caption]

It looks as if last year the promoters experimented with occasionally sending to a much larger mailing list, but for the most part this year have been restricting their mailings to people who have signed up on one of their web sites. This is a smart move on their part as it means that spam filtering services such as Cloudmark's are much less likely to blacklist their mailings.

Almost sixty percent of the stock promotion emails over the period I listed come from just two corporations, Awesome Penny Stocks and Victory Mark. Not so coincidentally, these two were recently sued for spamming by anti-pump and dump campaigner George Sharp. While I can't comment on lawsuits in progress, you rock George.

Finally, let's return to 1720 and the South-Sea company. Robert Walpole, speaking in parliament, warned against stock speculation. It would, he said, "divert the genius of the nation from trade and industry. It would hold out a dangerous lure to decoy the unwary to their ruin, by making them part with the earnings of their labour for a prospect of imaginary wealth. The great principle of the project was an evil of first-rate magnitude; it was to raise artificially the value of the stock, by exciting and keeping up a general infatuation, and by promising dividends out of funds which could never be adequate to the purpose." Nobody listened to him back then, either.

More resources